-- Global Stocks News – Sponsored by TRU Precious Metals. On July 30, 2024 TRU Precious Metals (TSXV:TRU, OTCQB:TRUIF, FSE:706) announced that it has signed an option agreement with Eldorado Gold (TSX:ELD, NYSE:EGO).

Today Eldorado’s market cap is CAD $4.7 billion while TRU’s market cap is CAD $5.7 million, making Eldorado 800 X bigger by market cap.

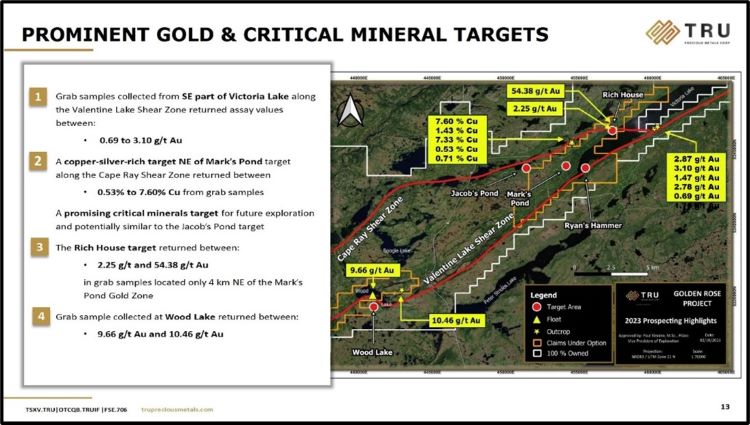

The agreement gives TRU access to the geological expertise and financial resources of a major mining company, while Eldorado gains a foothold in the gold deposit-bearing Cape Ray – Valentine Lake Shear Zone in Central Newfoundland.

Eldorado can earn an 80% ownership interest in TRU’s Golden Rose Project by paying TRU $250,000/year for the next four years, and spending $7 million on exploration in the next five years.

Upon execution of the option, Eldorado will pay another $7 million to TRU, making the total value of the deal, $15,250,000.

“Golden Rose is the marquee asset in Southwest Newfoundland,” TRU CEO Joel Freudman told Guy Bennett, CEO of Global Stocks News (GSN). “It has three important features: 1. high grade gold, 2. high grade copper, 3. we are flanked between two major gold deposits.”

“Calibre Mining purchased one deposit earlier this year for $340 million,” continued Freudman. “Calibre’s five-million-ounce Valentine gold mine is currently under construction. They are targeting annual output next year of 195,000 ounces on a 12-14 year mine life. The asset on the other side of Golden Rose is a 600,000 ounce gold deposit owned by AuMega Metals. We control all the land between these two deposits.”

“We are thrilled to partner with Eldorado to advance the Golden Rose Project,” stated Freudman in the July 30 2024 PR, “which we consider a strong endorsement of the work completed since optioning the initial land package from Altius Minerals in 2021.”

“Eldorado’s expenditures under the Option Agreement will accelerate the advancement of the project’s gold and copper potential, while the cash payments will help fund TRU’s corporate overhead as we remain operator of the Project.”

The agreement anticipates that “TRU will initially act as operator of the Golden Rose Project. A technical committee, comprised of three Eldorado representatives and two TRU representatives, will review work programs, exploration expenditures and provide guidance on operations.”

“Although TRU are the operators of the Golden Rose Project,” Freudman explained to GSN, “Eldorado will have input into the design and execution of the exploration programs through the technical committee. Eldorado’s expertise and guidance are extremely valuable to us.”

The Option Agreement is subject to TRU’s receipt of certain permits required to conduct Exploration Expenditures.

“About six weeks ago we filed for a trenching permit and a drill permit,” confirmed Freudman. “We have the trench permit in hand and expect to have the drill permit shortly.”

The Fraser Institute’s Investment Attractiveness Index combines the Policy Perception Index (PPI) and results from the Best Practices Mineral Potential Index.

The 2023 Survey of Mining Companies, ranks Newfoundland & Labrador the 9th most attractive global mining jurisdiction.

“Newfoundland is a Tier 1 mining jurisdiction,” Freudman told GSN. “We have access to a skilled labor force. A provincially maintained highway runs through the middle of the Golden Rose project. We can explore year-round, including drilling through the winter. We’ve had meetings with the Newfoundland mining minister and his staff. They are informed, motivated and responsive to our corporate objectives.”

Upon Eldorado exercising the Option, TRU and Eldorado will negotiate and enter into a joint venture agreement.

If TRU’s interest in such joint venture is diluted below 10%, its interest would convert to a 2% net smelter returns royalty, of which 1% would be re-purchasable by Eldorado for $5,000,000 at the time of commercial production.

On July 25, 2024, Eldorado reported Q2, 2024 Financials. Highlights included 122,319 ounces of gold production, revenue of $297.1 million and cash, cash equivalents and term deposits of $595.1 million.

The proposed option agreement with TRU is a relatively small item on Eldorado’s 2024 global balance sheet. But ELD’s ongoing financial commitment to the Golden Rose project suggests that it sees a big future for this Newfoundland gold asset.

With Eldorado funding exploration, TRU should not have to raise money for the foreseeable future to conduct exploration work. The option agreement is non-dilutive for existing shareholders. In the last eight months, TRU has been buying back shares to strengthen the structure of the company.

TRU is a portfolio company of Resurgent Capital, a Canadian merchant bank providing venture capital markets advisory services and proprietary financing.

The completion of the granting of the option is expected in the next month.

Contact: [email protected]

Disclaimer: TRU Precious Metals paid GSN $1,500 CND for the creation of this content.

Contact Info:

Name: Guy Bennett

Email: Send Email

Organization: Global Stocks News

Website: http://www.globalstocksnews.com

Release ID: 89137274

Google

Google RSS

RSS