-- Vinovest Signals Bull Market Potential for Fine Wine Amid Economic Shifts

Vinovest, a leading fine wine investment platform, is forecasting a potential bull market for fine wine investments, driven by favorable economic conditions. As global liquidity increases and investors seek diversification, fine wine is emerging as a stable and appreciating asset class. With over $100 million in fine wine assets under management and more than 15,000 investors, Vinovest is well-positioned to guide investors through this promising moment.

Historically, fine wine has delivered strong returns with lower volatility compared to traditional asset classes, offering an attractive alternative for investors seeking stability and growth during periods of market uncertainty.

Shifting Market Dynamics Create New Opportunities for Fine Wine Investment

Economic shifts have created fresh opportunities for alternative investments. As traditional markets experience volatility, investors are turning to fine wine, drawn by its track record of consistent performance.

Vinovest’s CEO remarked, “Economic shifts often lead to increased demand for alternative investments, and this is a particularly opportune time to consider fine wine as a strategic asset.”

Over the last decade, fine wine has achieved annual growth rates of 10-12%, outperforming many conventional investments. This has positioned it as a standout choice for investors looking to hedge against market risks while gaining access to a stable, appreciating asset.

Vinovest Leverages Technology to Lead Fine Wine Investment Market

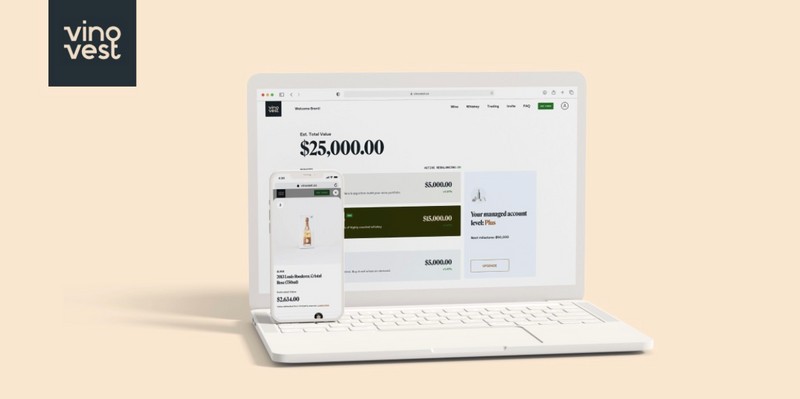

Vinovest has distinguished itself as a leader in fine wine investments by integrating advanced technology into its platform. The company uses AI-powered algorithms to analyze real-time market data, enabling personalized recommendations for investors. This data-driven approach helps investors navigate the complexities of the fine wine market with ease and confidence.

In addition to providing investment management services, Vinovest offers top-tier storage and comprehensive insurance for all wine assets. Wines are stored in secure, professional-grade facilities, and investors can track their portfolios through an intuitive, real-time dashboard. This seamless experience has contributed to Vinovest’s rapid growth and leadership in the U.S. fine wine investment market.

“Our goal is to make fine wine investment accessible to everyone, regardless of experience or financial background,” said the CEO. “By leveraging cutting-edge technology and industry expertise, we provide a fully managed, user-friendly investment experience.”

Fine Wine: A Stable Asset in a Fluctuating Economic Climate

As global markets continue to face uncertainty, fine wine remains a resilient and stable investment. During periods of economic turbulence, fine wine offers a low-risk alternative to traditional assets, making it an ideal choice for investors looking for both growth and security.

Current market conditions have driven increased interest in fine wine, which stands out as a low-volatility investment with strong growth potential. Vinovest’s platform helps investors tap into this opportunity by providing a streamlined and transparent way to access the fine wine market.

"Fine wine is a tangible, low-volatility asset that can both hedge against market uncertainty and provide a source of growth," noted Vinovest’s CEO. "In today’s economic climate, it’s a particularly strong option for diversification."

Interest Rate Cuts by 0.5% Expected to Boost Fine Wine Market

A recent 0.5% interest rate cut, larger than anticipated, is expected to positively impact the fine wine market. This cut, aimed at addressing inflation and stabilizing labor markets, is poised to boost luxury assets like fine wine by lowering borrowing costs and increasing liquidity.

As fixed-income assets become less attractive in a low-interest environment, investors are likely to shift toward alternative investments. Fine wine, with its long history of stable returns, is well-positioned to benefit from this trend. The reduced borrowing costs also offer advantages for wine collectors and distributors, encouraging them to expand inventories and grow their businesses.

The interest rate reduction may lead to increased investment in fine wine portfolios, bolstering liquidity and activity in this traditionally niche market.

Navigating a Bull Market in Fine Wine

As market conditions become increasingly favorable for fine wine investments, Vinovest’s AI-powered platform and market insights offer investors the tools to navigate the evolving market confidently.

Vinovest provides access to a wide range of wines, from rare collectibles to more mainstream options, ensuring flexibility and adaptability as the market shifts. Investors can easily buy, sell, or trade wine assets, allowing their portfolios to remain responsive to market trends.

“Our platform empowers investors with the data and tools they need to make informed decisions in the fine wine market,” said the CEO. “As economic conditions shift, this is an ideal time for investors to consider fine wine as part of their broader strategy.”

Vinovest Continues to Lead the Future of Wine Investment

Vinovest continues to set the standard in fine wine investment, combining advanced technology with deep industry expertise. The platform offers real-time market data, personalized recommendations, and comprehensive portfolio management, helping investors make sound decisions with confidence.

Through a fully managed marketplace for buying, selling, and trading wines, Vinovest provides liquidity and flexibility, something many traditional investments lack. As fine wine continues to outperform conventional asset classes, Vinovest is enabling a new generation of investors to unlock the full potential of this resilient asset.

About Vinovest

Vinovest is the world’s fastest-growing wine investment platform, offering accessible investment opportunities by combining advanced technology with deep wine market expertise. Managing over $100 million in assets and serving more than 15,000 investors, Vinovest democratizes fine wine investment through its AI-powered platform, simplifying portfolio management and providing access to a secure, fully managed marketplace.

Media Contact

Vinovest

Website: Vinovest.co

Contact Info:

Name: Anthony Zhang

Email: Send Email

Organization: Vinovest

Website: https://www.vinovest.co

Release ID: 89141772

Google

Google RSS

RSS