—

REDPAPER, an insight report on real estate data and trends by Frasers Property (Thailand) and Jones Lang LaSalle (Thailand) Company Limited, or JLL Thailand, forecasts an upsurge in the real estate industry, influenced by the global geopolitical landscape and the China Plus One policy. It also highlights the impressive growth momentum of the New S-Curve industries, which is driving continuous expansion in factories and warehouses. Additionally, the company has introduced innovative “built-to-function” solutions for Thailand's latest industrial buildings, catering to specific tenant needs and ensuring rapid relocation.

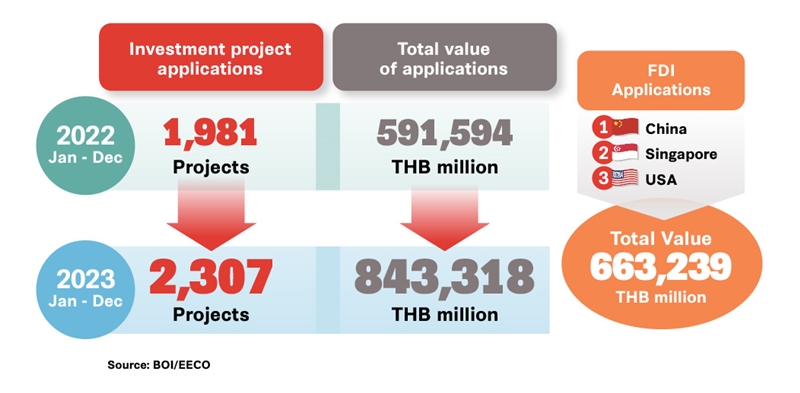

Titled ‘Insights on Thailand's Future-Focused Industrial Property Sector’, REDPAPER underscores the proactive expansion of industrial real estate, catalysed by significant growth over the past 2-3 years. This surge is fuelled by the rapidly expanding e-commerce sector, driven by economic dynamics and global geopolitical tensions, as well as international companies’ strategies to diversify investments beyond China. Thailand’s readiness, characterised by attractive investment promotion policies, strategic location, robust infrastructure, and skilled labour force, establishes the country as an attractive investment destination for foreign investors, especially in government-targeted industries for advancement.

Over the past decade, Thailand’s manufacturing sector has played a crucial role in the economy, contributing more than a quarter to GDP. Under the New S-Curve strategy, which aims to drive the economy through future industries, sectors like electric vehicle (EV) manufacturing and electronics and electrical appliance (E&E) manufacturing, particularly semiconductor products, have gained significant importance. These sectors are vital in terms of production and connectivity with other sectors such as robotics and communication networks, which requires close monitoring. In 2023, the EV manufacturing industry saw enormous growth of 380%, while the E&E industry expanded by 256% compared to the previous year,1 indicating a major increase in investment.

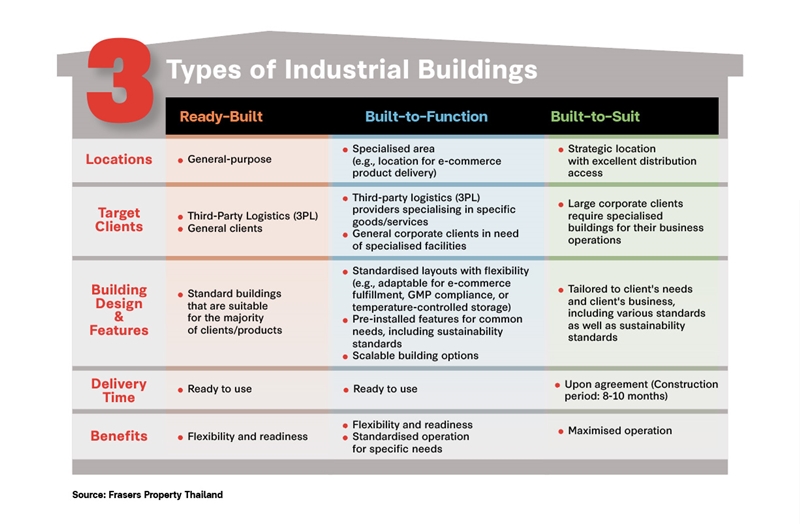

The growth of the above-mentioned industries has resulted in increased demand for rental spaces in factories and warehouses, attracting new players to the market. Between 2018 and 2023, there was an annual addition of 25,000 square metres of rental factory space and 282,000 square metres of warehouse space. Due to the diverse demands of the market, along with the capability of major providers to develop high-quality factories and warehouses, there has been innovation in the development of new types of industrial buildings that blend ready-built and built-to-suit approaches.

This new model is called “built-to-function”, which meets the needs of investors by delivering ready-to-use buildings that incorporate specialised features suited for standard structures. It is particularly suitable for logistics service providers (3PL) specialising in specific products/services as well as corporate clients who require specialised ready-to-use buildings.

Additionally, built-to-function industrial buildings help service providers reduce the risk of vacancy rates based on typical demand forecasts. This gives a competitive edge to real estate developers already engaged in developing ready-built and built-to-suit buildings by bridging market gaps through the enhancement of existing products.

A key trend that has influenced the development of industrial buildings recently is the interest of global investors in environmental, social, and governance (ESG) factors. These investors are looking for developers and service providers who can deliver high-quality buildings that meet sustainability standards. The international green building standard, Leadership in Energy and Environmental Design (LEED), has been applied to support sustainable operations in industrial real estate, which is a part of the value chain in business.

REDPAPER reports that Thailand’s extensive preparedness across various sectors, coupled with increased investment from foreign investors and the presence of leading industrial real estate developers, underscores the country’s readiness to grow as a major hub for manufacturing and distribution.

Read more at www.frasersproperty.co.th/th/downloads/redpaper

1 The growth of the EV industry is gauged by the number of registrations for all types of electric vehicles, while the growth of the E&E industry is evaluated through the value of investment promotion applications received by the BOI.

Release ID: 89130851

Google

Google RSS

RSS