-- The newly launched Employee Retention Tax Credit (ERTC) eligibility evaluation service is aimed at businesses that have over five W-2 employees. The ERTC is a US Government program that rewards businesses for paying their employees through the global health crisis lockdowns and shutdowns. The 2021 CARES Act Revisions instantly qualify small businesses impacted by city or state government mandated closures through 2021. ERTC.CASH states that many business owners wrongly believe the Employee Retention Tax Credit must be paid back. This is a common misconception. The payment is a check, not a loan, never needs to be paid back, and can be used for whatever purpose the business owner wants to use it for.

Find out more at https://www.ertc.cash

The Employee Retention Tax Credit program has been extended beyond 2020 and into 2021. The new service can help business owners who may have missed out, as the program can be applied for retroactively. This gives business owners the best chance of surviving current economic uncertainty.

ERTC.CASH states that business owners who have already applied for PPP can still apply to receive ERTC rebate checks. Through the newly launched service, business owners can apply for up to $5,000 for each employee in 2020, and $7,000 for each employee for the first three quarters of 2021. The maximum total for the program is $26,000 per W-2 employee.

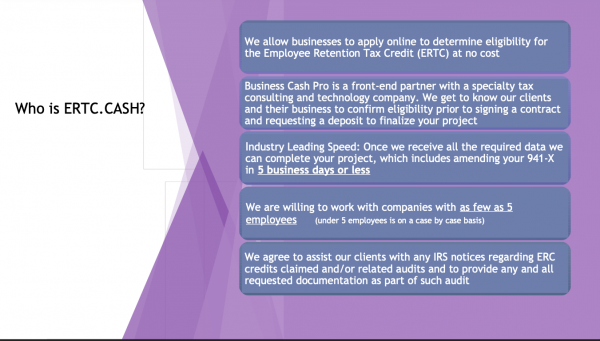

When business owners visit the ERTC.CASH website to use the new eligibility evaluation service, they will be required to answer some basic questions to enable the company to perform an analysis. There is no charge for this service, which gives business owners peace of mind.

Those who apply will work with CPA’s who specialize in the ERTC program. They are well placed to answer any queries business owners have as they understand the rules around this program. As they handle these claims daily, they are aware of updates or changes to legislation.

A company spokesperson said: “If you thought the tax credit was for 2020, you’re right. It was originally a 2020 credit. And it was either the Paycheck Protection Program (PPP) or ERTC. Almost every business chose the PPP option.”

“ERTC was not widely used until March 2021, when the American Rescue Act changed IRS regulations and millions of businesses were now eligible for both the PPP and ERTC program by amending their quarterly 941 form,” they added.

Interested parties are encouraged to visit this link to check their eligibility at no cost: https://www.ertc.cash

Release ID: 89056642